By Elliott Brack

Editor and Publisher, GwinnettForum

JULY 8, 2022 | Equally taxing people is complicated.

![]() For the tax year 2022, you could have two families living side-by-side in similar houses and one might be taxed considerably higher than the other. That’s because some Gwinnett residents get the benefit of a value offset exemption (VOE) for owner-occupied residences. With this in place, and if a resident has lived on this property since when the VOE went into place back in 2001, this resident would never see a county tax increase unless the County Commissioners raised the millage rate. With VOE, even if your property assessment was raised, the county property tax would not rise as long as you lived in that house.

For the tax year 2022, you could have two families living side-by-side in similar houses and one might be taxed considerably higher than the other. That’s because some Gwinnett residents get the benefit of a value offset exemption (VOE) for owner-occupied residences. With this in place, and if a resident has lived on this property since when the VOE went into place back in 2001, this resident would never see a county tax increase unless the County Commissioners raised the millage rate. With VOE, even if your property assessment was raised, the county property tax would not rise as long as you lived in that house.

The VOE only works for residents who apply for a homestead exemption. The Regular Homestead Exemption applies to all county property owners who occupy the property as of January 1 of the application year.

There are 35 counties in Georgia, plus the City of Atlanta, that offer some sort of value freeze exemption. Since inception in 2001 through 2021 Gwinnett County has foregone about $550 million in revenues. Due to rising home values, the projected impact of the exemption in 2022 is about $149 million assuming the millage rate stays the same.

The Value Offset Exemption holds the taxable value of a property constant for only the county government portion of your tax bill, even if there is an increase in property value. The Value Offset Exemption does not offer an exemption on school or city taxes, and applies to the home and up to five acres.

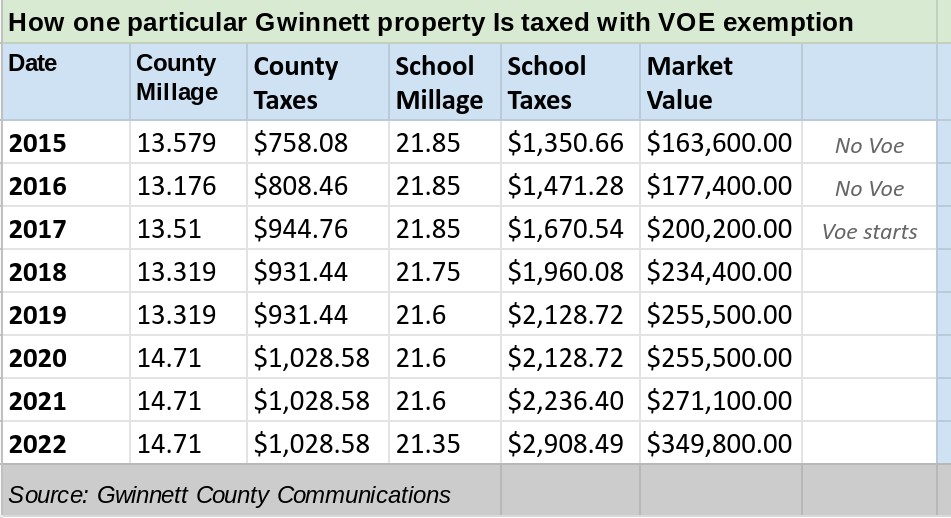

Let’s give one example: a house outside Lawrenceville. This couple bought their house in 2015, but it was until 2016 that they were residing there on January 1. That meant that their VOE exemption did not apply until the 2017 tax year, when their county taxes were $944.76. For 2018 and 2019, with a small reduction in millage, their county tax fell slightly to $941.44. Then in 2020, with a county millage increase, their county tax went up to $1,018. Note that it remains the same with the same millage in 2021 and 2022.

But at the same time, look at the market value of their home, going up from $163,600 when they first lived there, to more than doubled in 2022…at $349,800. But their county tax went up only slightly because of a small millage increase. VOE saved then a tax on the increased assessment.

VOE exemption applies only to county taxes, not city or school taxes. So, with a higher assessment, all property for those living in cities will see a city tax increase when assessments rise.

Up until now, we’ve been talking about owner-occupied housing. Residential properties that are not owner-occupied (rental properties) and commercial properties will see an increase in county property taxes this year because of increases in assessed value. This is turn-around time, since during the great recession, almost all properties in Gwinnett saw reduced property taxes because of value decreases.

Unfortunately, the amount of taxes you and other residents, and especially private businesses pay, is often influenced by the Legislature’s passage of many exceptions to routine taxes. Remember Delta Air Lines exemption? The airline almost lost a $35 million jet fuel tax benefit after Republicans in the Georgia General Assembly sought to punish the Atlanta-based company for speaking out against the state’s controversial new elections law.

Another: Shrimp fishermen are exempted from paying taxes on their fuel purchases. After all, they argue, shrimpers don’t use the Georgia highways, so exempt us!

Exemptions to routine taxes abound in many industries and counties. The VOE in a few counties is one way to keep taxes low when home assessments are rising for long-term residents who remain in their home. Pulling it would result in loud howlings.

So the VOE remains. It’s another way of saying that the efforts of government taxing property is complicated. And yes, it’s not always fair.

- Have a comment? Send to: elliott@brack.net

Follow Us