By Elliott Brack

Editor and Publisher, GwinnettForum

SEPT. 6, 2022 | Gwinnett County Commissioners can avoid raising taxes in future years, even with a growing budget, if they will take a step now to ensure fairness among the county taxpayers.

![]() That’s because real property owners of Gwinnett are being reassessed this year, meaning most everyone will soon see an increase in their taxes. Property tax notices went out last week, but that tax was based on the previous year’s assessments.

That’s because real property owners of Gwinnett are being reassessed this year, meaning most everyone will soon see an increase in their taxes. Property tax notices went out last week, but that tax was based on the previous year’s assessments.

There likely will be an increase in property taxes next year……unless the county commission soon takes a deliberate step. That step would be to seek bids from outside professional firms to reassess every single parcel of property in Gwinnett, commercial and residential. The good news is: while paying a professional reassessment firm would be expensive, in reality it would cost the county nothing, since the reassessed property would certainly bring in major additional revenue, far offsetting a cost of the reassessment.

Yes, yes, we know. The county has just reassessed property. But this was all done “in house,” and was not a comprehensive reassessment that takes far more time. Not only that, but we anticipate that the professional reassessment firm would find many parcels of property that, on inspection, would value the property not just a little more, but far more, than is presently on the books.

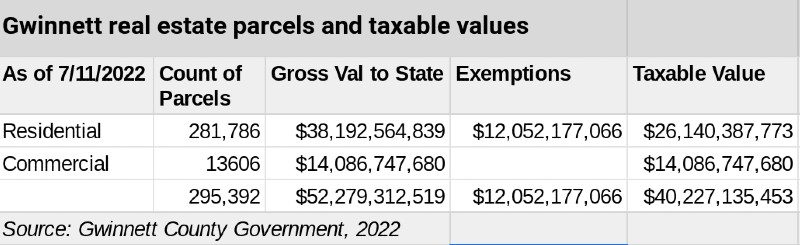

Look at the table below, provided by Gwinnett County Government. It shows that residential property owners are now paying 65 percent of the county budget, while commercial property pays 35 percent. Over the years, Gwinnett County has tried to make taxes more equitable between commercial and residential property. This shows that, with years going without a professional reassessment, the two levels of ownership get out of whack, obviously not equitable.

How do we know the present assessments are out of whack? Just ask yourself: as a homeowner in the county, or if you owned a business, would you sell your property for what the county has it valued? Probably in 99 out of 100 cases, of course you would not. You could never rebuild your home or your business for the money you would get if you sold it for what the county values it.

The upshot is that the county could significantly drop the millage by several mills and still come out far ahead. But the key element is that all property would be rated more equitably. We suspect that, also, the commercial and residential property would be more closely equal, resulting in a fairness for both groups. For the average homeowner taxpayer, it would be a significant drop in their tax bite, we predict, while giving the county more funds with which to operate.

But the major point is that it would be fair to all.

There’s another consideration: re-evaluation of commercial property would be a wise move for the individual county commissioners to remain in office. For if the county commission does not re-evaluate property, and the homeowners see a higher tax bill, the voters will rebel, and probably vote the commissioner out of office. Why not? For the individual commissioners would not be behaving in a financially prudent and fair manner.

Re-assess the commercial property, commissioners. For your own good, and for the county too.

Matching teams and stadiums: From last week (click to see chart), here are the answers to match:

A-2, B-11, C-28, D-19, E-10, F-13, G-29, H-12, I-22, J-8, K-7, L-16, M-14, N-9, 0-15, P-1, Q-26, R-30, S-5, T-23, U-6, V-4, W-21, X-20, Y-18, Z-25, AA-3, BB-27, CC-24, DD-17.

If anyone got them all, let us know!

- Have a comment? Send to: elliott@brack.net

Follow Us