Click here to see Gwinnett’s consolidated sample ballot for the 2022 general election

By Elliott Brack

Editor and Publisher, GwinnettForum

OCT. 25, 2022 | Gwinnett County’s economy is not a perpetual motion machine, though it seems to act like one. Gwinnett is unique because it constantly changes, and not just a little, but has been changing considerably since 1950 because of its continued population growth. That in turn, fuels a growing economy. It’s nearly a circular maneuver.

![]() Gwinnett’s economy also acts according to Newton’s First Law of Motion: “A body at rest will remain at rest unless an outside force acts on it.” But Gwinnett never remains at rest, and instead reflects the rest of that First Law: “A body in motion at a constant velocity will remain in motion in a straight line unless acted upon by an outside force.”

Gwinnett’s economy also acts according to Newton’s First Law of Motion: “A body at rest will remain at rest unless an outside force acts on it.” But Gwinnett never remains at rest, and instead reflects the rest of that First Law: “A body in motion at a constant velocity will remain in motion in a straight line unless acted upon by an outside force.”

There’s no “constant velocity” to its economy, but Gwinnett has a constant upward direction. While the pandemic slowed the national economy, the county continued to grow.

Therefore, if Gwinnett is anticipated to continue to grow at this remarkable speed, why not develop to help pay for the growth which will continue?

Gwinnett found that magic back in 1986. The county adopted its first Special Purpose Local Option Sales Tax, which the voters of the county determined was the best way to pay for a new courthouse, our current Gwinnett Judicial and Administrative Center. This one cent in tax on purchases made in Gwinnett has been endorsed by the voters to help pay for much of the infrastructure in the county since then. These amenities have in turn made the county more attractive, fueling more growth and better community.

It pays outside the normal county budget for all sorts of activities, public parks, roads, bridges, fire and police stations and public safety, libraries, senior services, animal welfare projects, and varied hard equipment for the county.

Think how much higher your property tax would be if Gwinnett did not have sales tax collections coming in pay for these vitally needed structures and activities?

Now here’s an unusually major element: Gwinnett is a mecca for retail sales, with people from neighboring counties flocking here to make their day-to-day and high-dollar retail purchases, hauling sacks of groceries and all kinds of other items back home.

But Gwinnett benefits, since it is estimated that 40 per cent of all retail sales are made by people who live in other counties. So thankfully, they help pay for its infrastructure needs! Without these purchases by those who live outside the county, our taxes would be higher.

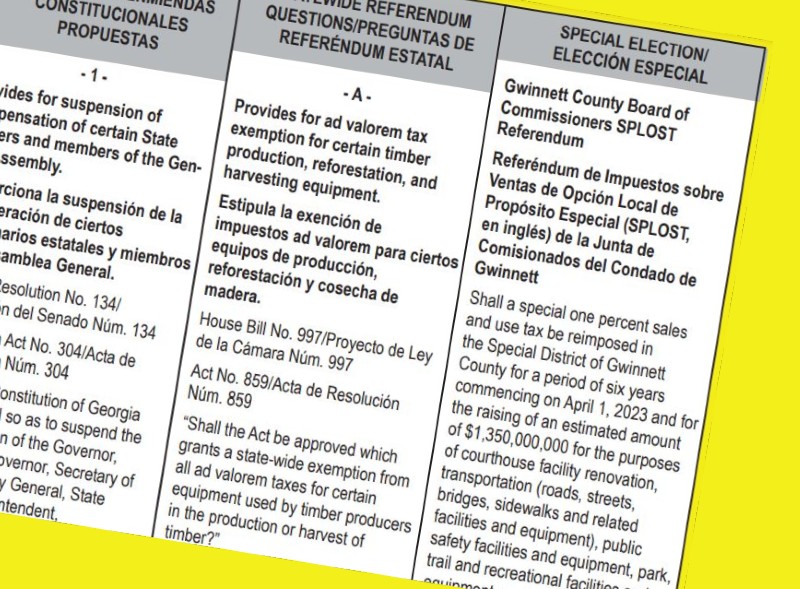

On the ballot this election, the last item is the proposal for Gwinnett citizens to extend the current one cent sales tax. Note that this is not a new sales tax, but is merely to continue a new sunsetted special purpose local option sales tax in Gwinnett, starting April 1, 2023. That new tax is expected to bring in as much as $1.35 billion dollars to pay for new facilities and equipment for the county. Of the total sales tax collected in Gwinnett, one-fourth of the monies will go to Gwinnett cities for their own infrastructure projects.

When marking your ballot, be sure to go to the very last item on the ballot, and vote “YES” on the referendum to extend the sales tax. You’ll help keep Gwinnett on its movement onward, showing as Newton described many years ago, that this Gwinnett body, indeed, has outside forces (population growth) acting on it, and we all know the county does not remain at rest.

- Have a comment? Send to: elliott@brack.net

Follow Us